Beauty Bestseller: Sephora Spring Sale Insights from 6.3K Unsponsored Videos

Powered by Plot’s social listening, we analyzed 6,300+ organic posts and 50,000+ comments to uncover what actually drove beauty shoppers during the Sephora Spring Sale.

Every spring, beauty brands flood social feeds with campaigns for Sephora’s big sale. But beneath the paid promotions and influencer codes, something more honest is happening:

Consumers are using the Sephora Sale as a strategic chance to try something new without paying full price.

At Plot, we went straight to the source: We analyzed over 6,300 social posts and 50,000 comments from Instagram and TikTok during and immediately after the Sephora Spring Sale 2025. Importantly, we only analyzed organic, unsponsored content — real posts, real conversations, no #ad tags allowed.

Here’s a peek at what we discovered 👇

🎉 Brands That Stole the Spotlight

After analyzing millions of views and thousands of posts, two clear kinds of winners emerged during the Sephora Spring Sale:

Brands that captured the most attention and

Brands that sparked the most conversation.

Here’s who stood out in organic, unsponsored content:

Different Peaks, Different Strengths

Saie (

) led by far in total views meaning fewer posts reached more people. (Breakout product moments with massive organic reach.)- and Charlotte Tilbury dominated both views and post volume, a sign of deep consumer advocacy, not just viral attention.

Makeup by Mario sparked conversation but had a slightly lower reach, showing strong loyalty among core fans.

Attention and conversation aren’t the same thing but together, they paint the full picture of who truly won the Sephora Sale organically.

💄 Products That Stole the Spotlight

Blush wasn’t just trending during the Sephora Sale — it was the main event.

’s Soft Pinch Liquid Blush, Charlotte Tilbury’s Airbrush Flawless Setting Spray, and Huda Beauty’s Easy Bake Setting Powder led the list of most talked-about purchases, with face products dominating overall.The full report breaks down the entire list of top performing products across brands like Dior, Saie, Patrick Ta, Kosas, and more and digs into what made some products break through.

👄 Makeup Reigns Supreme Especially Blush

Despite skincare’s steady rise, makeup still dominated the conversation. In fact, makeup made up nearly half (47.8%) of all product-related comments.

The real MVPs? Face products and lip products, which together accounted for over 58% of total sale chatter. Top discussed categories:

Blush (most mentioned!)

Concealer

Foundation

Lip gloss

Setting spray

If you're a beauty brand thinking about where to focus for Spring/Summer 2025, face and lip are where the action is🔍 Sephora Sale = Prime Time for Product Discovery

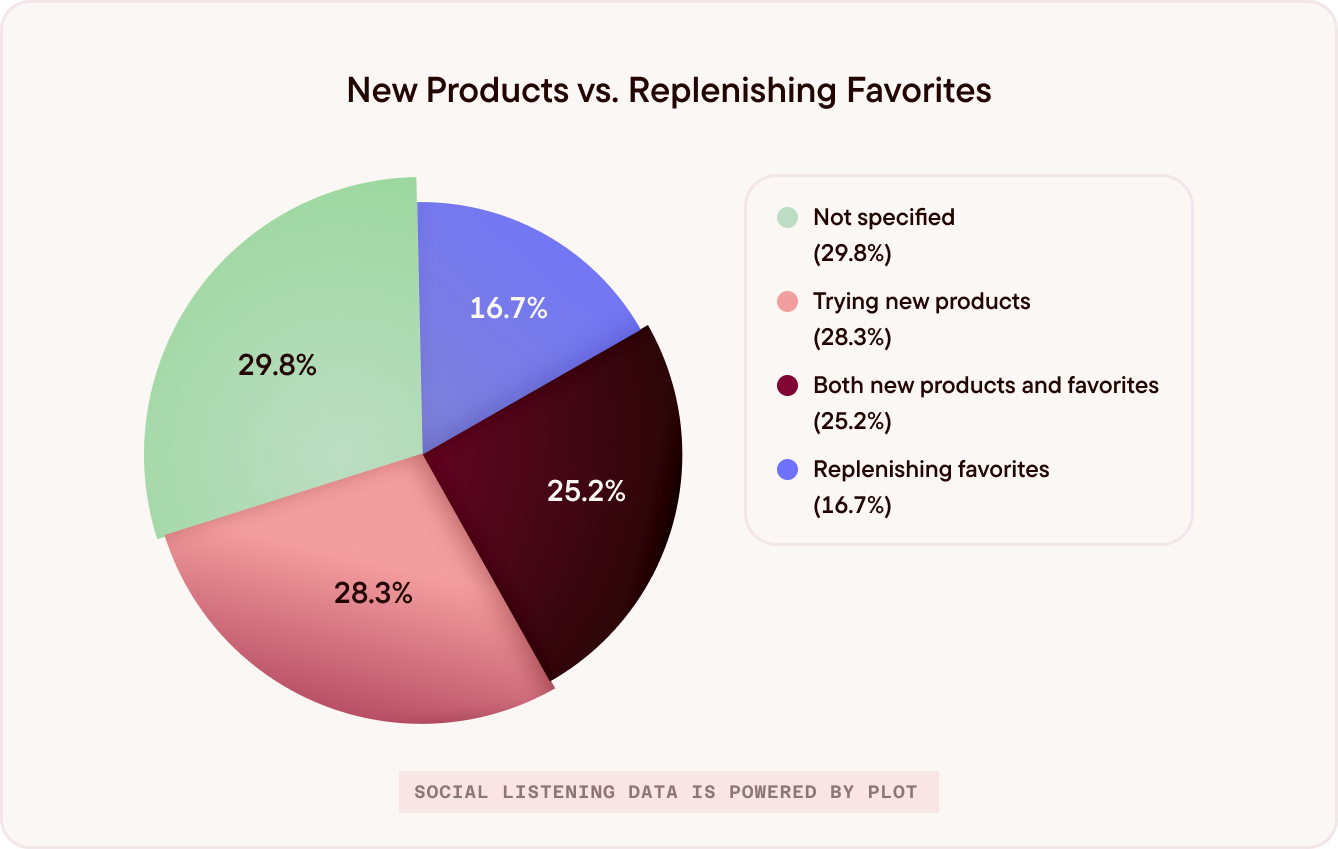

More than half of shoppers weren't just restocking favorites they were trying something new.

51.6% of posts mentioned trying new products.

Discovery sets, minis, and new launches saw heightened attention.

For beauty brands, this is a massive opportunity: frame your sale messaging around discovery, not just savings.

💋 Lip Gloss and Hydration Win Big

Lip gloss is the most discussed lip product category, followed by lip liner and lip balm, reflecting current beauty trends emphasizing glossy finishes over matte.

In organic content, lip products from Charlotte Tilbury, Dior, and

receive the most mentions. In contrast, lip products from Sephora Collection and Fenty Beauty feature more prominently in paid content.Wrapping Up

This post just scratches the surface. The full Sephora Sale report dives deeper into the shifts we're seeing in beauty buyer behavior — from how consumers are weighing value vs. splurges, to where price sensitivity is showing up, to what’s actually driving conversations around dupes and product discovery.

If you're looking for the data behind what beauty shoppers are thinking (not just what they're buying) the full report is worth the read!

Data powered by Plot’s AI Analyst

Plot’s AI Analyst lets us generate extensive reports on any topic using social listening and powerful visual ID to analyze all social content – even videos that aren’t tagged but show a relevant product for a split second. Our reports cover a breakdown of content volume and distribution, common messaging patterns, sentiment analysis, and noteworthy findings.

This is FASCINATING. Love how powerful Plot is and how creative it was to use it to unearth these insights! Thanks for sharing!